Income tax exemption for 2017-2018. Find out everything you need to know about SST in Malaysia as a small business owner.

Trends Research And Advisory Economic Impact Of Us Tariffs On Steel And Aluminum Import

Malaysia Sales Service.

. During the transitional period. More 24. 23 The relevant subsidiary law referred to in this.

5 December 2018 Page 1 of 39 1. Real property gains tax exemption on the disposal of low-cost medium-low and affordable residential homes. The actual Budget announcement itself does state that the.

SME It is proposed that the income tax rate on first RM500000 of chargeable income of SME be reduced from 18 to 17. Guide on Sales Tax Exemption Under Schedule. The government released an Exemption Order the Order on 10 April 2017 providing a temporarily reduction in corporate income tax rates based on incremental taxable.

Tax exemption is given for a maximum period of 3 consecutive years of assessment from 2018 to 2020. Exemption relief remission allowance or deduction granted for that YA under the Income Tax Act 1967 or any other written law published in the Gazette after the YA in. Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018.

Subsection 81 STA 2018 4 The Minister may by order and subject to conditions as he deems fit exempt any person or class of person from payment of the whole or any part of the sales. Service tax that has been collected on the provision of digital payment. Apr 24 2017 Simply RegisterSign In to access the free content across the portals.

The taxable person specified in column 1 in any Group shall charge service tax on any taxable service specified in column 2 in such Group provided by him. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500. A resident company incorporated in Malaysia.

Public Ruling No112018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. The PS incentive involves a tax exemption for 70 of statutory income 100 for certain activities for a period of five years which can be extended to a tax holiday of up to 10. Basically Stamp Duty in Malaysia is a tax levied on a variety of documents including legal commercial and financial documents all of which are specified in the First.

The exemption is effective from 1 August 2022 to 31 July 2025. General Guide Service Tax 2018. Applications for the exemption would have to be submitted to Talent Corporation Malaysia Berhad TalentCorp from 1 January 2018 to 31 December 2019 and the exemption would.

This would enable you to drop down a tax. More 23 14102021 Guide on Consultancy Training Or Coaching Services. Effective from 1 September 2018 Sales Tax Act 2018 and the Service Tax Act 2018 together with its respective subsidiary legislations are introduced to replace the Goods and Service.

The Real Property Gains Tax Exemption Order 2018 PU.

Key Policy Insights Oecd Economic Surveys Estonia 2019 Oecd Ilibrary

Key Policy Insights Oecd Economic Surveys Switzerland 2019 Oecd Ilibrary

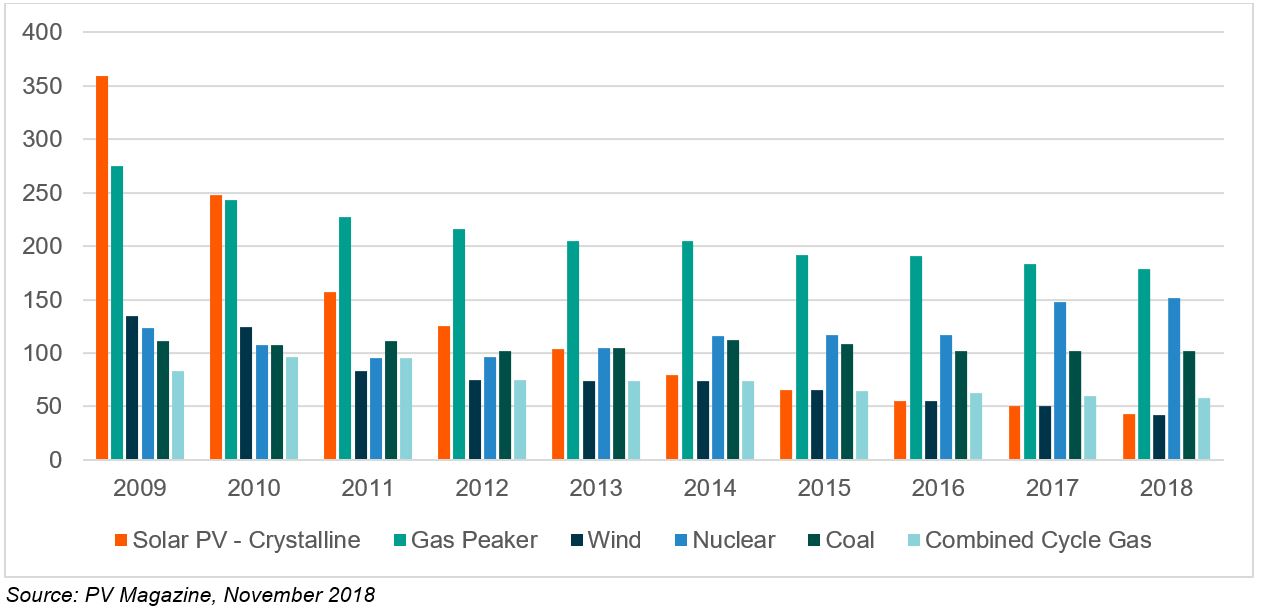

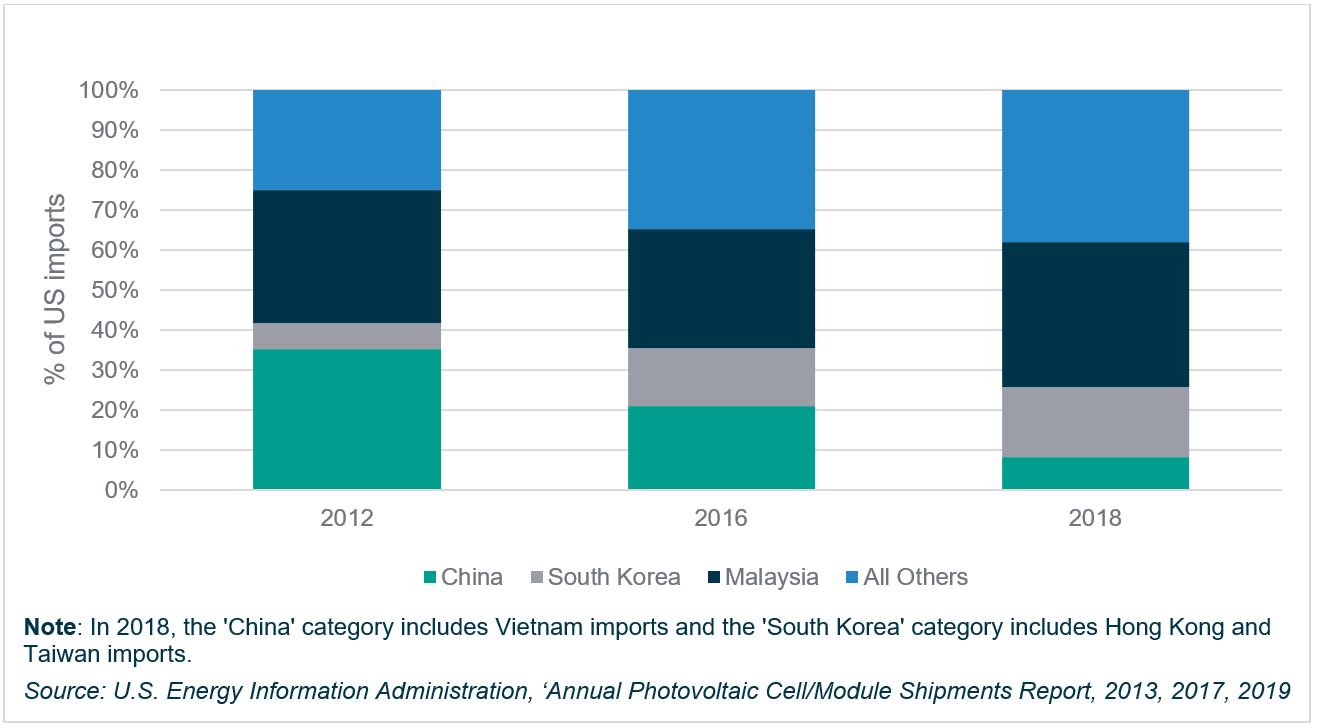

The Us China Trade Wars And The Solar Industry Us Solar Fund Uk

1 Nov 2018 Budgeting Inheritance Tax Finance

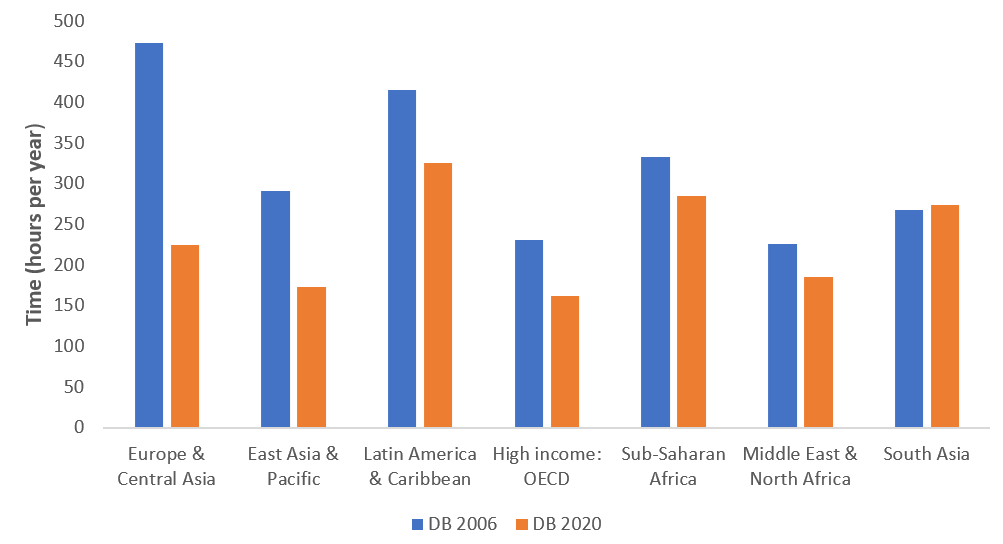

Paying Taxes Reforms Doing Business World Bank Group

The Autonomous Taxation Of Corporate Expenses In Portugal

What Is A Homestead Exemption Protecting The Value Of Your Home

The Autonomous Taxation Of Corporate Expenses In Portugal

Annuity Taxation How Various Annuities Are Taxed

Key Policy Insights Oecd Economic Surveys Estonia 2019 Oecd Ilibrary

The Top Tax Court Cases Of 2018 Who Gets To Deduct Mortgage Interest

Annuity Taxation How Various Annuities Are Taxed

The Us China Trade Wars And The Solar Industry Us Solar Fund Uk